In 2003, just over five million Medicare beneficiaries enrolled in a Medicare Advantage plan, which represented only 13 percent of the total Medicare beneficiary population.

By 2022, total Medicare Advantage enrollment more than tripled to reach more than 28 million, which is nearly half of all Medicare beneficiaries.2

What could this growth trend tell us about the future of the Medicare Advantage program? Here are four possibilities based on current health care trends.

Medicare Advantage plans may continue to offer more new benefits

Medicare Advantage plans offer the same benefits that are covered by Medicare Part A and Part B (Original Medicare), and many Medicare Advantage plans offer additional benefits not covered by Original Medicare.

These extra benefits may include coverage for:

- Prescription drugs

- Dental care

- Vision care

- Hearing care and hearing aids

These additional benefits can serve as an incentive to consumers. Some plans even offer more benefits like memberships to gyms or wellness programs such as SilverSneakers.

These extra benefits first have to be approved by the Centers for Medicare & Medicaid Services (CMS) before being included in a plan.

In 2018, CMS expanded its definition of the “primary health-related” benefits that insurance companies are allowed to include in Medicare Advantage plans. As a result, new benefits are available to be added to some Medicare Advantage plans.

These new benefits may include services such as:

- Home-delivered meals

- Air conditioners for people with asthma

- Transportation to doctor’s offices

- Grab bars in home bathrooms

Medicare Advantage plan prices should remain stable or possibly drop

The number of available Medicare Advantage plan options in the U.S. is on the rise.

In 2012, there were a total of 1,974 Medicare Advantage plans available nationwide. By 2022, that number increased to 3,834. Also in 2022, the average Medicare beneficiary can choose from 39 available plan options, the largest number of plans in a decade.2

With more Medicare Advantage plan options being sold by more providers, the increased competition between insurance companies helps keep costs low for consumers.

And with more benefits being approved for use, plan providers may gain even greater flexibility with their pricing and coverage offerings.

Quality of care could get better

The Affordable Care Act (also known as Obamacare) put an incentive system in place for Medicare Advantage plans. Beginning in 2012, plans that provide high-quality care will receive a bonus or rebate. By law, the bonus money must be reinvested in additional plan benefits.

Going forward, Medicare Advantage plan providers will no doubt continue to adapt and improve the quality of the plans they offer in order to meet these bonus requirements.

In addition to the bonus program, Medicare issues star ratings for all Medicare Advantage plans each year, and these Medicare Star Ratings can be a large point of emphasis for shoppers.3

Medicare offers a Special Enrollment Period for anyone who is not enrolled in a five-star Medicare Advantage plan (the highest Medicare Star Rating) and wants to switch to one. The continued emphasis on star ratings by Medicare Advantage consumers could help keep plan quality in check for years to come.

Enrollment will continue to climb

If Medicare Advantage plan benefits and quality continue to increase while prices remain stable or possibly drop, Medicare Advantage enrollment will likely continue to go up as well.

The Baby Boomer generation is now aging into Medicare eligibility, and there are more people age 65 and older in America with each passing day.

One company that provides Medicare Advantage plans, pulled out of the individual health insurance exchange in 2018 to invest more heavily in the Medicare Advantage program.4

Steven Nelson, CEO of Medicare Advantage plan provider, predicted that 50% of seniors will soon be enrolled in a Medicare Advantage plan.5

Enrolling in a Medicare Advantage plan

Nobody knows for sure what the future will hold, but there are plenty of reasons to be optimistic about the future of Medicare Advantage plans.

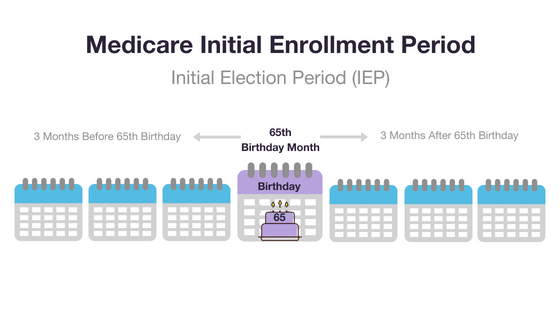

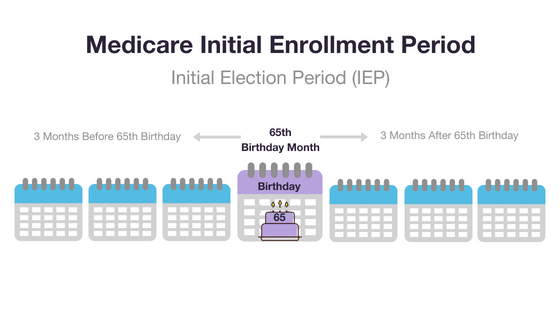

You can enroll in a Medicare Advantage plan during your Initial Enrollment Period, when you first become eligible for Medicare.

You can also enroll in a Medicare Advantage plan during the annual Fall Open Enrollment Period, which lasts from October 15 to December 7 each year.

To learn more about Medicare Advantage plans in your area, call to speak with a licensed insurance agent today.

Compare plans today.

Speak with a licensed insurance agent