Last Updated: 5/27/2025

|

If you are enrolled in a Medicare Advantage plan rated lower than five stars but you find a five-star plan in your area, you may be able to switch to the five-star plan at any time between December 8 and November 30 of the following year. This is called the five-star Special Enrollment Period. Compare plan Star Ratings online or speak to a licensed insurance agent today to switch to a 5 star Medicare Advantage plan if you're eligible by calling 1-800-557-6059 TTY Users: 711. We accept calls 24/7! |

Quick links:

2025 Medicare Enrollment Dates

The chart below summarizes important Medicare enrollment periods.

Be sure to refer to this chart so that you don't miss out on your chance to enroll in the coverage you need during the correct Medicare sign up period.

|

Enrollment period |

2025 Dates |

Actions you can take during this period |

|---|---|---|

|

Initial Enrollment Period |

- Starts 3 months before the month you turn 65 |

- Sign up for a plan |

|

Medicare Open Enrollment Period |

- Starts October 15, 2025 |

- Sign up for a plan |

|

Special Enrollment Period |

- Depends on your personal situation (such as if you move or lose your insurance coverage) |

- Depends on your personal situation (such as if you move or lose your insurance coverage) |

|

General Enrollment Period |

- Started January 1, 2025 |

- Sign up for Medicare Part A and/or Part B (only if you didn't sign up when first eligible and if you're not eligible for a Special Enrollment Period) |

|

Medicare Advantage Open Enrollment Period |

- Started January 1, 2025 |

- Switch Medicare Advantage plans |

Medicare enrollment and benefits can be confusing.

If you are currently eligible for Medicare or are nearing the age of Medicare eligibility, it’s vital to understand the Medicare enrollment dates. Signing up as soon as you are eligible can help avoid a costly late enrollment penalty.

This guide provides the information you need to know about Medicare enrollment periods, as well as other resources you can explore for answers to coverage questions and help with paying some of your health care costs.

Keep reading to learn how you can enroll in the coverage that fits your needs.

We offer plans from Humana, UnitedHealthcare®, Anthem Blue Cross and Blue Shield*, Aetna, Cigna Healthcare, Wellcare, or Kaiser Permanente.

Enrollment may be limited to certain times of the year. See why you may be able to enroll.

New to Medicare? Compare plans in your area

Compare plansOr call 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

Who Is Eligible for Medicare?

You are eligible for Medicare Part A and Part B at age 65 if:

- You are a U.S. citizen or permanent legal resident who has lived in the U.S. for five continuous years

- You or your spouse have worked long enough to be eligible for Social Security or Railroad Retirement benefits

- You or your spouse are government employees or retirees who have not paid into Social Security but have paid Medicare payroll taxes

You can meet Medicare eligibility under 65 if you:

- Have been receiving Social Security disability benefits or certain Railroad Retirement Board disability benefits for at least 24 months

- You have ALS (amyotrophic lateral sclerosis or Lou Gehrig's disease)

- You have End-Stage Renal Disease (ESRD) and you or your spouse have paid Social Security taxes for a certain length of time

When to Enroll in Medicare

Some People Get Medicare Automatically

You may be automatically enrolled for Medicare Part A and Part B benefits if you are age 65 and already receive Social Security or Railroad Retirement benefits.

If you are under age 65, you may be automatically enrolled if you have received Social Security or Railroad Retirement disability benefits for 24 calendar months.

If you are automatically enrolled, you will receive your red, white and blue Medicare benefits card in the mail. Your Medicare coverage will begin either on the first day of the month during which you turn 65 or on the first day of your 25th month receiving disability benefits.

If you are under 65 and have ALS/Lou Gehrig’s disease, your Medicare benefits will start the same month your disability benefits begin — there’s no 24-month waiting period.

New to Medicare? Compare plans in your area

Compare plansOr call 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

Manual Medicare Enrollment

You may need to manually sign up for Medicare if one of the following circumstances apply to you:

- You are approaching your 65th birthday, meet Medicare eligibility requirements and do not currently receive Social Security or Railroad Retirement board benefits

- You are under 65 and eligible for Medicare because you have ESRD

- You are over age 65 and you did not enroll in Medicare when you were first eligible

Veterans who receive VA coverage and are eligible for Medicare can also consider enrolling in Medicare Part A and Part B. If you have VA benefits as well as Medicare coverage, your options for care and your coverage net can be widened. Your qualified care would be covered under Medicare Part A and/or Part B, even if you go to a non-VA hospital or doctor.

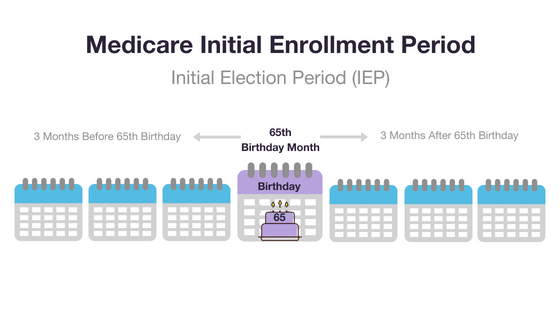

Medicare Initial Enrollment Period (IEP)

The earliest time you can enroll in Original Medicare, a Medicare Advantage plan or a Medicare Part D prescription drug plan is during your Medicare Initial Enrollment Period (IEP).

Your Initial Enrollment period lasts for seven months:

- It begins three months before you turn 65

- It includes your birth month

- It extends for another three months after your birth month

If you are under 65 and qualify for Medicare due to disability, the 7-month period is based around your 25th month of disability benefits.

Medicare General Enrollment Period

If you don't sign up during your Initial Enrollment Period and if you aren't eligible for a Special Enrollment Period, the next time you can enroll in Medicare is during the Medicare General Enrollment Period.

The General Enrollment Period lasts from January 1 to March 31 each year.

You can only sign up for Part A and/or Part B during this period, and your coverage starts on July 1. You may have to pay a late enrollment period for Part A and/or Part B, as detailed below.

|

Your Part B monthly premium could go up 10 percent for each 12-month period that you were eligible for Part B but didn't sign up. You pay the Part B late enrollment penalty for the rest of your life as long as you remain enrolled in Part B. |

Medicare Advantage Plan Enrollment

When you’re eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Advantage (Medicare Part C) plan. You need to enroll in Original Medicare before you enroll in Medicare Advantage. Before enrolling in a plan, it may be a good idea to compare Medicare Advantage quotes.

- 99 percent of 2025 Medicare Advantage plans include additional vision benefits for eye exams and eyeglasses/contacts, and 95 percent of plans offer fitness benefits such as SilverSneakers membership. 97 percent of plans offer hearing exams and hearing aids and/or dental benefits.2

- Every year, Medicare evaluates plans based on a 5-star rating system. According to the Centers for Medicare & Medicaid Services (CMS), the average star rating for a Medicare Advantage plan in 2025 is 3.92.3

- Roughly 62% MA-PD plan beneficiaries are enrolled in a 2025 plan rated 4 or more stars.3

To be eligible for Medicare Part C, you must already be enrolled in Part A and Part B.

If you are interested in joining a Medicare Advantage plan, you typically can only do so during specific times of the year.

The first time you may be able to enroll is during your Medicare Initial Enrollment Period, as outlined above.

If you sign up for a Medicare Advantage plan during your Initial Enrollment Period, you can change to another Medicare Advantage plan or switch back to Original Medicare within the first 3 months that you have Medicare.

A licensed insurance agent can help you compare plans options available where you live.

Are you looking to switch Medicare Advantage plans? Are you enrolling for the first time?

Compare plansOr call 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent.

Medicare Part D Prescription Drug Plan Enrollment

When you’re eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Part D prescription drug plan.

If you want Medicare prescription drug coverage, you typically have two options:

- Enroll in a Medicare Advantage plan that includes Part D prescription drug coverage, Medicare Part A hospital insurance and Part B medical insurance combined into a single plan

- Enroll in a Medicare Part D standalone prescription drug plan (PDP) that can be paired with other insurance such as Original Medicare (Parts A and B), Medicare Supplement (Medigap) plans or Medicare Advantage plans that don't include drug coverage

In 2024, 17.9 million Medicare beneficiaries were enrolled in a standalone Part D Medicare drug plan.4

Learn more about Part D drug coverage. You can also enroll in a prescription drug plan online when you visit MyRxPlans.com.

Fall Medicare Open Enrollment Period

If you choose not to sign up for a Medicare Advantage plan or stand-alone Medicare prescription drug coverage during your Initial Enrollment Period, you can also enroll in a Medicare Advantage plan during the annual Fall Medicare Open Enrollment Period.

The 2025 Medicare Open Enrollment period is also called the Medicare Annual Election Period (AEP).

This period runs from October 15 to December 7 every year.

During the Fall Medicare Open Enrollment Period for Medicare Advantage and Medicare prescription drug coverage, you can:

- Enroll in, make changes to or disenroll from a Medicare Advantage plan (Medicare Part C)

- Enroll in, make changes to or disenroll from a Medicare Prescription Drug plan (Medicare Part D)

Plan changes you make during the 2025 Medicare Fall Annual Enrollment Period go into effect January 2026.

Is Medicare Open Enrollment Still Open?

No, the 2024 fall Medicare Open Enrollment Period for Medicare Advantage plans and Medicare prescription drug coverage began October 15 and ended December 7, 2024.

During 2025 fall Medicare open enrollment, you may be able to drop, switch or enroll in a Medicare Advantage or Medicare Part D prescription drug plan for the 2026 plan year.

Find Medicare Advantage plans in your area

Compare plansOr call 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent.

Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period starts January 1 and ends March 31 every year. During this period, you can switch Medicare Advantage plans or leave a Medicare Advantage plan and return to Original Medicare.

Medicare Special Enrollment Period (SEP)

Depending on your circumstances, you may also qualify for a Special Enrollment Period (SEP).

Medicare Special Enrollment Periods can happen at any time during the year. You may qualify for a Special Enrollment Period for a number of reasons, which can include:

- You moved to a new area that is outside of your current Medicare Advantage plan's service area

- You left your employer coverage

- Medicare ended your current Medicare Advantage plan's contract

A licensed insurance agent can help you find out if you qualify for a Medicare Special Enrollment Period.

Medicare Supplement Insurance (Medigap) Enrollment

If you have Original Medicare and would like to enroll in a Medicare Supplement Insurance plan (also called Medigap), the best time to sign up is during your six-month Medigap Open Enrollment Period.

- Your Medigap Open Enrollment Period starts as soon as you are age 65 or older and are enrolled in Medicare Part B.

- Insurance companies cannot deny you Medigap coverage or charge you a higher fee for pre-existing health conditions if you apply for Medicare Supplement Insurance during your Medigap Open Enrollment Period.

If you don’t sign up for a Medigap plan during your Medigap Open Enrollment Period, you may still be able to buy one at any time.

Insurance companies can take your health into consideration when setting your premiums or deciding whether or not to offer you coverage, however.

You must be enrolled in Medicare Part A and Part B in order to buy a Medigap plan.

Medigap and Medicare Advantage plans are very different, and you cannot be enrolled in a Medigap plan and a Medicare Advantage plan at the same time.

Learn more about the differences between Medicare Advantage vs. Medicare Supplement Insurance.

Request a free, no-obligation Medicare Supplement Insurance quote today by visiting MedicareSupplement.com.

How to Apply for Medicare

Whether you are signing up for Original Medicare, a Medicare Advantage plan or other Medicare coverage options, you can get started by checking your eligibility today.

Signing up for Original Medicare

You can sign up for Medicare one of four ways:

- Apply online on the Social Security website

- Visit your local Social Security office

- Call Social Security at 1-800-772-1213 (TTY: 1-800-325-0778)

- If you worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772

- Complete an Application for Enrollment in Part B (CMS-40B)