Speak with a licensed insurance agent

Medicare Expert Q&A: What Are the Different Medicare Enrollment Periods?

Medicare expert Christian Worstell explains the different – but very important – Medicare enrollment periods and what you can do during each period to change or add to your Medicare coverage.

In this Q&A series, Medicare expert Christian Worstell answers your questions about Medicare coverage, benefits, eligibility, enrollment and more. Christian is a licensed insurance agent and frequent contributor to MedicareAdvantage.com.

Have a question for Christian? Ask it here.

"I’m a little confused. I always thought you enrolled in Medicare when you turned 65, but lately I’ve been hearing a lot about a Medicare enrollment period in the fall and other types of enrollment periods throughout the year. Could you clarify what the different types of Medicare enrollment periods are?" – Charles H., Lubbock, TX

Hi Charles. I’ll start out by saying that you are correct on each of these three things:

- Most people enroll in Medicare when they turn 65 years old.

- There is a widely used enrollment period that takes place every fall.

- There are additional enrollment periods at various times during the rest of the year.

You’re right about one more thing as well: Medicare enrollment periods can be confusing. I’ll try to clear things up.

Enrolling at age 65 – Initial Enrollment Period

Most people (i.e. people who do not qualify for Medicare due to a chronic disability) qualify for Medicare when they turn 65 years old.

If you are collecting Social Security retirement benefits by age 65 and qualify for Medicare, you will typically be automatically enrolled, and you’ll receive your Medicare card in the mail.

If you are not collecting Social Security benefits for at least four months prior to turning 65, you must manually enroll in Medicare.

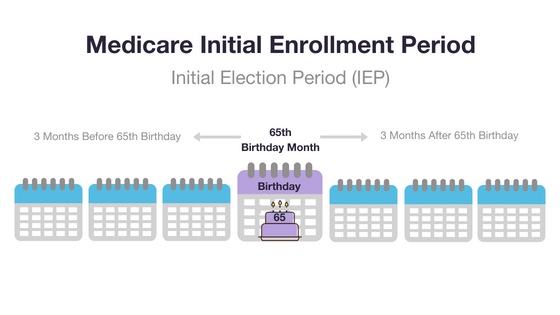

The earliest you can typically enroll is during what’s called your Initial Enrollment Period (IEP), which begins three months before you turn 65. Your IEP also includes the month of your birthday and continues on for another three months, for a total of seven months.

For anyone without a qualifying disability, this Initial Enrollment Period is the first time you can enroll in Medicare (hence the name “initial”).

Enrolling after your IEP – General Enrollment Period

One enrollment period when you may be able to enroll in Medicare is the General Enrollment Period, which lasts from January 1 to March 31 each year. Your coverage would not begin until July 1 of that year — so you could have a lapse in health insurance.

This enrollment period is for those who did not sign up for Medicare during their Initial Enrollment Period and don’t qualify for a special enrollment period due a special circumstance. Beneficiaries signing up for Medicare in this period are often paying late enrollment fees, so it’s best to avoid having to sign up at this time if at all possible.

Enrolling, dropping or switching Medicare Advantage or Medicare drug plans – Annual Enrollment Period

The next most widely utilized enrollment period is the Annual Enrollment Period, which takes place from October 15 to December 7 each year (hence the name “annual”).

This enrollment period – commonly referred to as AEP or “open enrollment” – only involves beneficiaries who wish to add, drop or switch private Medicare Advantage or Medicare Part D prescription drug plans.

In other words, this enrollment period is not focused on beneficiaries enrolling for the first time in Original Medicare (the government-provided portion of Medicare, Medicare Parts A and B). Remember, your initial Medicare enrollment is based on when you turn 65.

Enrolling during other times of the year due to special circumstances – Special Enrollment Periods

Next, you have Special Enrollment Periods (SEP). These may be granted at any time throughout the year to people who find themselves in certain circumstances, such as moving to a new area or losing employer health coverage.

If you work past age 65 and don’t take Social Security Retirement benefits at that time, you may be able to delay signing up for Medicare and remain on your employer-provided insurance group plan. If you do so, you may qualify for a Special Enrollment Period to enroll in Medicare after you retire and leave your group plan.

Note that there are lots of considerations to keep in mind if you delay enrolling in Medicare to remain on other group insurance. Be sure to check with your employer’s HR department, and you may consider speaking with a representative from your local State Health Insurance Assistance Program.

Getting help comparing Medicare plans

Still confused? We’ve got you covered. You can use our Medicare Enrollment Guide to help guide you through the enrollment process.

If you’re curious about the Medicare Advantage (Medicare Part C) plans or the Medicare Part D prescription drug plans that may be available where you live, you can compare plans online for free, with no obligation to enroll.

You may also call to speak with a licensed insurance agent who can help you compare costs, benefits, coverage and more for the plans that may be available in your area.

Compare Medicare plans in your area

Compare PlansOr call 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles he’s written, helping Americans better understand their health insurance and Medicare coverage.

..Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles he’s written, helping Americans better understand their health insurance and Medicare coverage.

Christian’s work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! Finance.

Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare. His articles are read by thousands of older Americans each month. By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care.

Christian’s passion for his role stems from his desire to make a difference in the senior community. He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result.

A current resident of Raleigh, Christian is a graduate of Shippensburg University with a bachelor’s degree in journalism.

If you’re a member of the media looking to connect with Christian, please don’t hesitate to email our public relations team at Mike@tzhealthmedia.com.