1 Cubanski J, Damico A. (Nov 8, 2023). Medicare Part D in 2024: A First Look at Prescription Drug Plan Availability, Premiums, and Cost Sharing. Kaiser Family Foundation. www.kff.org/medicare/issue-brief/medicare-part-d-a-first-look-at-medicare-drug-plans-in-2023.

Part D

What Is Medicare Part D?

Medicare prescription drug coverage is typically offered through the following types of Medicare plans:

- Medicare Advantage (Part C) plans that include prescription drug coverage, called Medicare Advantage Prescription Drug (MA-PD) plans

- Standalone Medicare Part D prescription drug plans (PDP)

Medicare Part D provides prescription drug coverage for Medicare enrollees. Part D plans are offered by private insurers, not the federal government.

Each Part D prescription drug plan may have varying benefits, costs and rules.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

By clicking "Sign me up!” you are agreeing to receive emails from MedicareAdvantage.com.

To compare Medicare Advantage Prescription Drug plans where you live, you can call to speak with a licensed insurance agent. You can also compare plans online for free. We represent carriers such as Humana, UnitedHealthcare®, Anthem Blue Cross and Blue Shield, Aetna, Cigna Healthcare, Wellcare, or Kaiser Permanente.

Compare Medicare Advantage and prescription drug plans online.

Speak with a licensed insurance agent

You can also compare Part D plans online when you visit MyRxPlans.com.

When can I enroll in a Part D plan?

| Enrollment period | Dates | What you can do during this period |

|---|---|---|

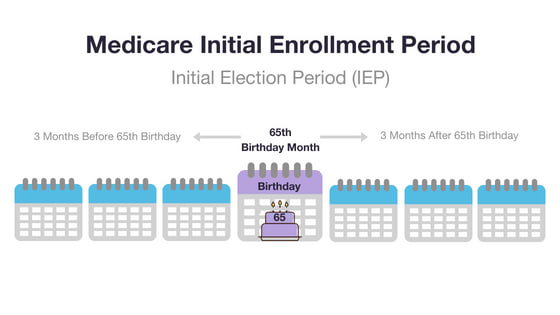

| Initial Enrollment Period (IEP) | Starts 3 months before the month you turn 65 Ends 3 months after the month you turn 65 |

- Sign up for a Medicare Part D plan |

| Medicare Open Enrollment Period (aka the Annual Enrollment Period, or AEP) | Starts October 15 Ends December 7 |

- Sign up for a Medicare Part D plan - Switch Medicare Part D plans - Leave a Medicare Part D plan |

| Special Enrollment Period (SEP) | Depends on your personal situation. See more information below. | - Depends on your personal situation |

You must wait for a qualifying enrollment period to sign up for, make changes to, or leave a Medicare Part D plan.

You are 65 (or turning 65) and signing up for Medicare Parts A and B

You can join a Medicare prescription drug plan during your Initial Enrollment Period (IEP).

Your IEP is 7 months long. It starts 3 full months before the month you turn 65. It continues through the month of your 65th birthday, and then for another 3 full months.

Example: You turn 65 on June 5. Your IEP starts on March 1 (3 full months before June) and ends September 30 (3 full months after June).

If you are enrolling during your IEP, your coverage will start at the following times:

- If you are 65: the first day of the month after you ask to join a plan

- If you are under 65: the first day of the month you turn 65

You have Medicare Part A and are signing up for Part B during General Enrollment

You can enroll in a Medicare prescription drug plan between April 1 and June 30.

You are disabled and under 65

You can enroll in a Medicare prescription drug plan after you have been getting Social Security or Railroad Retirement Board benefits for 21 full months. After that point, you have 7 full months to enroll in a Medicare prescription drug plan.

You have a Medicare prescription drug plan and want to switch, make changes to, or drop your plan

You can make changes to your current Part D plan, switch plans, or drop your prescription drug coverage entirely during the annual fall Medicare Open Enrollment Period, which runs from October 15 to December 7 each year.

Also called the Annual Enrollment Period (AEP) or the Annual Election Period, this period takes place every year between October 15 and December 7.

During AEP, you may:

- Enroll in a Medicare Part D plan

- Switch from one Part D plan to another

- Disenroll in a Part D plan

- Enroll in a Medicare Advantage plan

- Switch from one Medicare Advantage plan to another

- Disenroll from a Medicare Advantage plan

If you make changes during this time, your new coverage will begin on January 1 of the following year.

Special Enrollment Period

A Special Enrollment Period (SEP) may be granted for people who have specific qualifying circumstances.

These qualifying situations include, but are not limited to:

- Losing creditable drug coverage through no fault of your own

- Moving outside of your drug plan’s service area

- Experiencing contract or enrollment errors or violations

- Moving into or out of a skilled nursing facility or nursing home

- Gaining or losing eligibility for a Special Needs Plan

A licensed insurance agent can help you find out if you qualify for a Special Enrollment Period. Depending on your qualifying circumstance, you may or may not be eligible to enroll in a Part D plan a certain Special Enrollment Period.

How do I apply for a Medicare Part D prescription drug plan?

Are you looking to enroll in a Medicare Part D prescription drug plan?

To compare plans where you live, you can call to speak with a licensed insurance agent. You can also compare plans online for free when you visit MyRxPlans.com.

Eligible Medicare beneficiaries can only enroll in Medicare prescription drug coverage during predetermined enrollment periods unless they have a Special Enrollment Period due to a qualifying life event.

What does Medicare Part D cover?

Part D plans have different formularies, tiers, coverage rules, and pharmacy networks.

Coverage rules such as quantity limits, prior authorization and step therapy may limit how and when you receive your prescription drugs.

Part D plans also can have pharmacy networks, which may impact the cost of your prescription drugs.

How much do Part D plans cost?

Medicare Part D prescription drug plans don't pay for everything.

If you have a Part D plan, you may have to pay premiums, "donut hole" drug costs, and other out-of-pocket costs like deductibles and copayments.

Medicare Part D plan beneficiaries pay 25 percent of their brand name and generic drug costs while they’re in the Part D donut hole coverage gap.

How do I compare Medicare prescription drug plans?

You can compare Medicare Part D plans and Medicare Advantage Prescription Drug plans online or call to speak with a licensed insurance agent to get help comparing plans available where you live.

There are many Part D plans to choose from. There are 709 2024 Part D plans offered nationwide.1

What is a Medicare formulary?

A Medicare formulary is the list of prescription drugs that are covered by a particular Medicare Part D or Medicare Advantage plan.

Each plan includes its own formulary that determines which drugs are covered by the plan and how much the drugs cost based on which tier the drug is classified into.

Drugs on a Medicare formulary are divided into tiers that determine the cost paid by beneficiaries.

For example, a tier 1 drug might consist of low-cost, generic drugs and require only a small copayment in order to fill a prescription. A tier 4 drug, however, might be a more expensive name brand drug that requires a higher copayment.

The number of drug tiers and the cost breakdown will vary according to each plan.

Drugs may be added or removed from the market at any time, and therefore drugs may be added or removed from a plan’s formulary. Drugs may also remain for sale on the market but be removed from a plan’s formulary for a variety of reasons.

Beneficiaries reserve the right to request that a Medicare plan cover a particular drug. You can also request to pay a lower amount for a covered drug.

All Medicare formularies generally must include coverage for at least two different drugs within most drug categories, and they must include all available drugs for the following categories:

- HIV/AIDS treatments

- Antidepressants

- Antipsychotic medications

- Anticonvulsive medications to treat seizure disorders

- Immunosuppressants

- Anticancer drugs not covered by Medicare Part B

A Medicare formulary won’t include over-the-counter drugs or weight-loss drugs.

Some drugs on a Medicare formulary come with certain types of restrictions, such as:

- Prior authorization

Beneficiaries may be required to show that they meet certain criteria for consuming the particular drug. - Step therapy

Beneficiaries must first try a less-expensive form of a drug that has been proven effective before being covered for the more expensive version. - Quantity limits

There may be a restriction on the dosage amount of a drug or the frequency that the prescription may be filled. - Opioid safety limits

Opioids often contain restrictions for coverage, and doctors will usually work with a beneficiary and a pharmacist to determine a safe level of opioid prescription for each patient.

How do I determine the best type of plan for me?

Of course, your current list of prescription medications is a great place to start in understanding how extensive you need your Part D plan to be.

Make a list of every prescription drug you currently take and make note of whether or not the prescription is a brand name or generic option.

Check this list against the covered drug lists of the Part D plans you are evaluating.

It’s important to take a look at all the copays and costs for drugs that you are currently taking so that you get a sense of what the plan AND the costs of your regular medications will cost each year.

It is also important to note that no plan covers every single drug and copays may vary. You may be able to find lower out-of-pocket costs at specific pharmacies, depending on the plan.

Can Part D plans can change from year to year?

If this is your first time enrolling in Part D, you may be surprised by some of the variability in plans that you may experience each year.

There are a few major things that can change from year to year:

- The formulary (the list of prescription drugs that the plan covers)

- The costs assessed by the plan including premiums, deductibles and copays

This is why it’s important to check your Part D plan coverage every year.

Make sure you compare your current list of brand and generic prescription drugs against your plan’s new formulary and cost breakdown to see if you are still appropriately covered.

Medicare Part D late enrollment penalties

If you need prescription drug coverage, it is important to enroll in a Part D plan during your Initial Enrollment Period or when you are first eligible. If not, you may face a late penalty.

If your IEP ends and there is a period of 63 days or more in a row when you do not have creditable prescription drug coverage, you may have a late enrollment penalty added to your monthly premium for as long as you have Medicare prescription drug coverage.

|

Creditable coverage includes a Medicare Part D plan, a Medicare Advantage plan or a Medicare health plan that offers drug coverage, or other drug coverage that pays at least as much as Medicare's standard prescription drug coverage. The amount you pay for the Part D late enrollment penalty depends on how long you went without creditable drug coverage. |

Drug coverage is creditable if it pays – on average – at least as much as the standard Medicare prescription drug coverage.

About the author

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles he’s written, helping Americans better understand their health insurance and Medicare coverage.

Christian’s work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! Finance.

Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare. His articles are read by thousands of older Americans each month. By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care.

Christian’s passion for his role stems from his desire to make a difference in the senior community. He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result.

A current resident of Raleigh, Christian is a graduate of Shippensburg University with a bachelor’s degree in journalism.

If you’re a member of the media looking to connect with Christian, please don’t hesitate to email our public relations team at Mike@tzhealthmedia.com.