This guide explains 2025 Medicare Open Enrollment and other Medicare enrollment periods. Don't miss this important time to review and change your Medicare coverage.

Read moreSpeak with a licensed insurance agent

Speak with a licensed insurance agent

Compare plans today.

Licensed insurance agents from MedicareAdvantage.com can help you compare Medicare plans that may be available where you live. Learn what to expect when you call.

You may find that you have more than one option when it comes to your Medicare coverage.

For instance, many people choose to enroll in a Medicare Advantage plan (also called Medicare Part C), a Medicare Supplement Insurance plan (Medigap) or a Medicare Part D prescription drug plan, all of which are sold by private insurance companies.

A licensed Medicare insurance agent can help you learn more about each type of coverage. They can also guide you as you compare a number of Medicare plan options that may be available where you live.

Call today to get started with a licensed insurance agent.

When you speak with an agent, you can compare plans from a number of different insurance providers. Some of the Medicare plan options that may be available to you can include:

Not all plans are offered in all locations, and some carriers may not provide a Medicare plan where you live. A licensed agent can help you review the availability, costs and benefits of Medicare plans in your area.

Here are some questions you can ask a Medicare agent that may help you find a Medicare plan that works for you.

When you call an insurance agent about Medicare, he or she may ask you several questions to get a better idea of your insurance needs and the Medicare plans near you.

Your birth date helps an insurance agent know when you may be eligible to enroll in Medicare. Most people are eligible for Medicare three months before their 65th birthday.

If you’re interested in exploring your Medicare plan options, providing an agent with your zip code can help them find Medicare Advantage plans in your area.

Not all doctors accept Medicare as insurance, and some that do may charge more for their services.

Providing a Medicare agent with a list of your doctors can help them determine which of your doctors/providers participate in Medicare and whether they are in any Medicare Advantage plan networks near you.

Medicare agents are happy to answer any questions you have about Medicare, including how plans differ, how to enroll, and what to expect in out-of-pocket costs.

To help you get started, we’ve included a list of questions below that can help guide you on your call with a Medicare agent.

It helps to understand all of your Medicare plan options so that you can enroll in a plan that will allow you to get the most from your benefits.

Here are 5 frequently asked questions about Medicare that you may want to ask an insurance agent.

If you’ve been a United States citizen or permanent legal resident for at least five consecutive years, you may be eligible for Medicare Part A and Part B (also called Original Medicare) if you meet one or more of the following criteria:

There may be other circumstances that make you eligible for Medicare that are not listed here.

Most people who are enrolled in Original Medicare are eligible for Medicare Advantage plans, with the exception of people who have end-stage-renal disease, in most cases.

You may also be eligible for Medicare Supplement Insurance or a Medicare Part D prescription drug plan.

Original Medicare is made up of two parts: Medicare Part A (hospital insurance) and Medicare Part B (medical insurance).

Some examples of the types of services covered by Medicare Part A include:

Some examples of the types of services covered by Medicare Part B include:

Original Medicare does not typically cover prescription drugs or routine dental, eye care or hearing care.

Are you looking to enroll in Medicare prescription drug coverage?

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

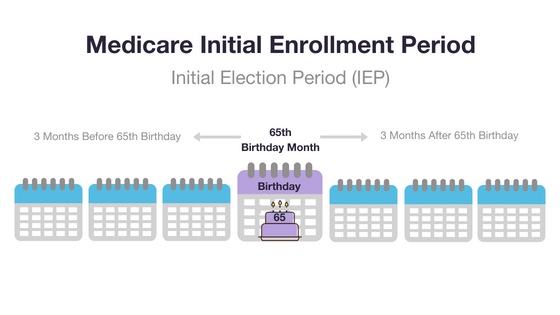

The best time to enroll in Medicare is during your Medicare Initial Enrollment Period.

For most people, this seven month period begins three months before your 65th birthday, includes your birthday month, and ends three months after your 65th birthday.

You must be enrolled in Original Medicare before you can enroll in Medicare Advantage.

There are specific times when you can sign up for Medicare Advantage and/or a Medicare Part D prescription drug plan. The first time is during your Medicare Initial Enrollment Period.

You also have the opportunity to enroll in a Medicare Advantage plan and/or a Medicare Part D plan during the Annual Election Period (also called Medicare Open Enrollment), which runs from October 15 to December 7 each year.

You may enroll in Medicare Advantage outside of these enrollment periods if you qualify for a Medicare Special Enrollment Period.

The first time that you can enroll in a Medicare Supplement Insurance plan is during your six-month Medigap open enrollment period, which starts as soon as you are both 65 years old and enrolled in Medicare Part B.

If you enroll outside of this period, you may be subject to medical underwriting by insurance providers, which can affect your plan eligibility and premium charges.

Neither Original Medicare, Medicare Supplement Insurance, Medicare Advantage or Medicare Part D provide family coverage, so you and your spouse must enroll separately once you’re each eligible for a Medicare plan.

The answer to this question varies from person to person, depending on the plan you’re enrolled in and your specific medical needs.

These out-of-pocket costs can help give you an idea of the types of charges you could face in 2023.

Premiums are what you pay each month for your Medicare benefits.

Most people do not pay a premium for Medicare Part A, as long as they paid sufficient Medicare taxes while working.

The standard Medicare Part B premium is $174.70 per month in 2024.

If you enroll in a Medicare Advantage plan, you still pay your Medicare Part B premium. Some Medicare Advantage plans require that you pay a Medicare Advantage premium in addition to your Part B premium.

Medicare Supplement plan costs and Medicare Part D plan costs will also vary based on your plan, your insurance provider and when you bought your plan.

Your Medicare Part A deductible is the amount you must pay out-of-pocket costs before Medicare will pay its share for covered services.

In 2024, the Part A deductible is $1,632 for each benefit period.

Your Medicare Part B deductible is the amount you must pay in medical costs before Medicare will pay its share for covered services. In 2024, the Medicare Part B deductible is $240 per year.

Some Medicare Supplement Insurance plans may cover the Part A and/or Part B deductible.

Medicare Advantage plan deductibles and Medicare Part D plan deductibles are determined by the insurer, so deductible amounts will vary by plan.

When you speak with a licensed insurance agent, he or she can provide more detailed information about deductible amounts for the Medicare plans in your area.

Coinsurance or copayments refer to the healthcare charges that you pay after your deductible is met.

2023 Medicare Part A coinsurance amounts are as follows:

The Medicare Part B coinsurance is typically 20 percent of the Medicare-approved amount for covered services. This means that you pay 20 percent, and Medicare pays 80 percent.

Medigap plans cover the Part A deductible in full, and they cover the Part B deductible either in part or in full.

Medicare Advantage and Medicare Part D coinsurance amounts are determined by the insurer, so coinsurance amounts will vary by plan.

When you speak with a licensed Medicare agent, he or she can provide more detailed information about coinsurance amounts for the Medicare plans in your area.

We want you to have the most successful conversation with a Medicare agent that you can have, and we hope you found this article helpful.

To learn more about your Medicare options, call today to speak with a licensed insurance agent.

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles he’s written, helping Americans better understand their health insurance and Medicare coverage.

..Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles he’s written, helping Americans better understand their health insurance and Medicare coverage.

Christian’s work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! Finance.

Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare. His articles are read by thousands of older Americans each month. By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care.

Christian’s passion for his role stems from his desire to make a difference in the senior community. He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result.

A current resident of Raleigh, Christian is a graduate of Shippensburg University with a bachelor’s degree in journalism.

If you’re a member of the media looking to connect with Christian, please don’t hesitate to email our public relations team at Mike@tzhealthmedia.com.